What is a Living Trust and do I need one? (Podcast)

/Michelle Castillo, an estate planning attorney in Granada Hills was recently featured in A Broad Productions podcast where she discusses what is a living trust. Click the audio below to listen now.

Visit A Broad Productions to listen to the full length podcast.

What is a Living Trust

A living trust is a 3-way agreement where the first party (trustor) creates an agreement that enables the second party (trustee) to poses rights to the trustor’s estate or assets for the benefit of the third party (beneficiary) when the trustor passes away.

A living trust is comprised of three parts:

1. Trustor

The trustor, also referred to as a grantor is the creator of the trust or agreement and authorizes the trustee the rights to assets, estate, or property

2. Trustee

The trustee is responsible for overseeing and managing the trust that was appointed to them by the trustor

3. The Beneficiary

The beneficiary is the person that receives the assets by the trustee, who is managing the trust on behalf of the trustor. In many cases, children or family members are listed as beneficiaries. There can be more than one beneficiary in the agreement.

How many types of Trust is there?

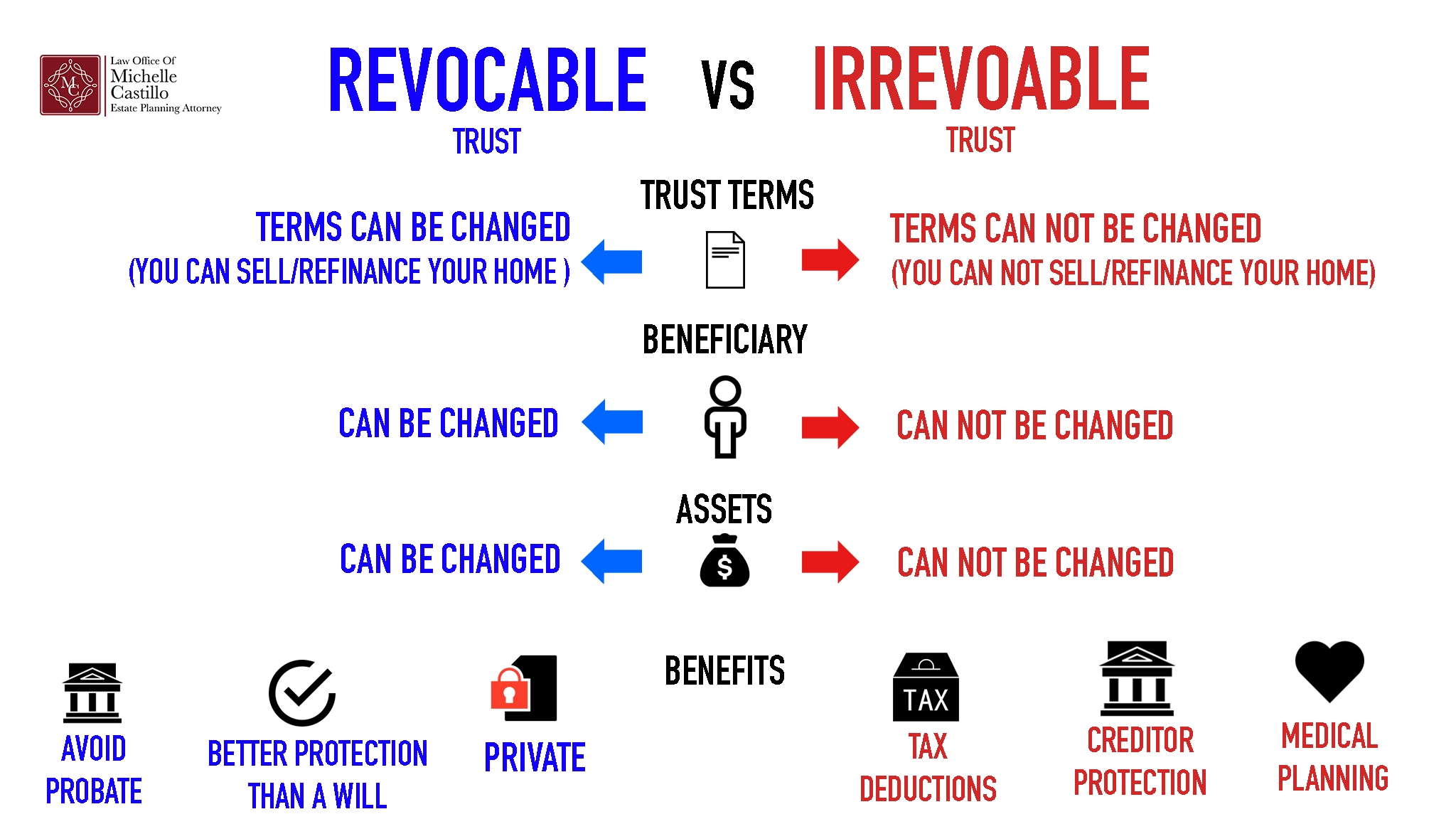

There are two primary trusts, a revocable and irrevocable living trust. All of which can be created with the help of an estate planning attorney.

1. Revocable Living Trust

Revocable living trusts are the most common type of living trust of the two main types because of the flexibility it possesses. With a revocable living trust, the terms of the trust can change as your desires and situation changes. Not only that, it can be canceled or rescinded, making it very appealing to most people. In most cases, revocable living trusts are made to avoid probate when the trustor passes away.

2. Irrevocable Living Trust

An irrevocable living trust does not allow any parties to make any changes or terminate the trust after the paperwork is finalized. This type of living trust goes into effect right away while the trustor is alive. There are many reasons for the creation of an irrevocable living trust that includes asset protection, wealth transfer, and tax reduction.

The figure below highlights key differences between a revocable and irrevocable living trust.

Every living trust varies so it is always best to check with an experienced living trust lawyer. Its always best to set up an in-person consultation or phone call to get a more in depth explanation of the living trust process in California. Michelle Castillo, a Granada Hills living trust lawyer understands how important a living trust is and is why her first consultations are free of charge. Book your free consultation today.

Below we highlight the 4 benefits of having a living trust.

Benefits of having a Living Trust

1. Avoid Probate

One of the best things about having a living trust in place is being able to avoid probate. Probate is a court proceeding that is held when a person passes away. Its main purpose is to determine the distribution of the deceased person estate and assets. The court decides who takes control of all assets and ensures that all debts are paid off. The probate process can be costly and time-consuming, all while going through the hardship of a family member’s death.

2. Save Money

The cost for probate includes attorney fees, executor fees, court filing fees, appraiser fees, and other expenses that may be accumulated. Michelle Castillo, an estate planning attorney says these fees can amount up to $23,000 or more. Moreover, probate takes many months to complete, sometimes surpassing a year. Keep in mind, an estate worth more and the longer things take, the higher the cost will be for the probate process.

3. Privacy during tough times

A living trust ensures peace of mind and ensures that no public records are taken of how assets or estates were transferred. As mentioned a living trust would remain confidential between the parties involved. You will not have to go through hardships of the court process (probate) having to talk about a recent death in a family can be tough. A living trust helps keep private matters within the family and ensures assets are transferred as desired by the trustor.

4. Protects you if you are incapacitated

A living trust is also desirable because it helps deal with situations when a person becomes incapacitated or ill. This process involves a power of attorney. Power of Attorney is the legal agreement granting another individual the rights to make decisions for you in the case you are unable to. A living trust enables a trustee to step in and make decisions on behalf of the incapacitated or ill individual. Without a living trust, the court will have to intervene and make the final decision. Having a living trust keeps the court away from all major decisions that need to be made.

About The Law Office of Michelle Castillo

The Law Office of Michelle Castillo is a trusted Granada Hills living trust lawyer. Her areas of practice are in Estate Planning, Living Trusts, Wills, Health Care Directives, Power of Attorney, Guardianship Nominations, Trust Administration, Probate and Asset Protection. She is fluent in English and Spanish and puts focus on helping families plan for the future. As always first consultations are free. Fill out the contact form with your details to schedule a free consultation.